Overview

Francis supports currency conversion for actuals, allowing you to translate data from your accounting system’s functional base currency into a chosen target (reporting) currency. You can pull market exchange rates directly from the European Central Bank (ECB) or use custom rates. Both average and closing rates are supported, offering flexibility to meet your reporting needs.Configuration

To enable currency conversion for your imported actuals, open Settings > Integrations and add a currency data source. You may choose either market rates or custom rates, both of which are configured on a monthly basis.- Market

- Custom

Market rates, sourced from the European Central Bank, are automatically imported and serve as the preferred choice for most users.

- Monthly closing rates: Imported directly from the ECB.

- Monthly average rates: Calculated as the arithmetic mean of the month’s daily closing rates (the sum of all daily closing rates divided by the number of days in the month).

Enabling conversion

To apply currency conversion to your actuals, open the configuration settings for the relevant accounting integration. Francis automatically detects the functional currency for your accounting system’s data. Simply specify the exchange rate data source and select your target currency. If you are importing data from a Google Sheets source, you will need to manually define the functional currency.Conversion method and effects

Francis uses a standard approach to currency conversion:- Income and expenses (P&L): Translated at the monthly average exchange rate. This approach approximates transaction-date exchange rates.

- Assets, liabilities, and equity: Translated at the monthly closing exchange rate, ensuring that balance sheet items reflect the financial position at the end of each period.

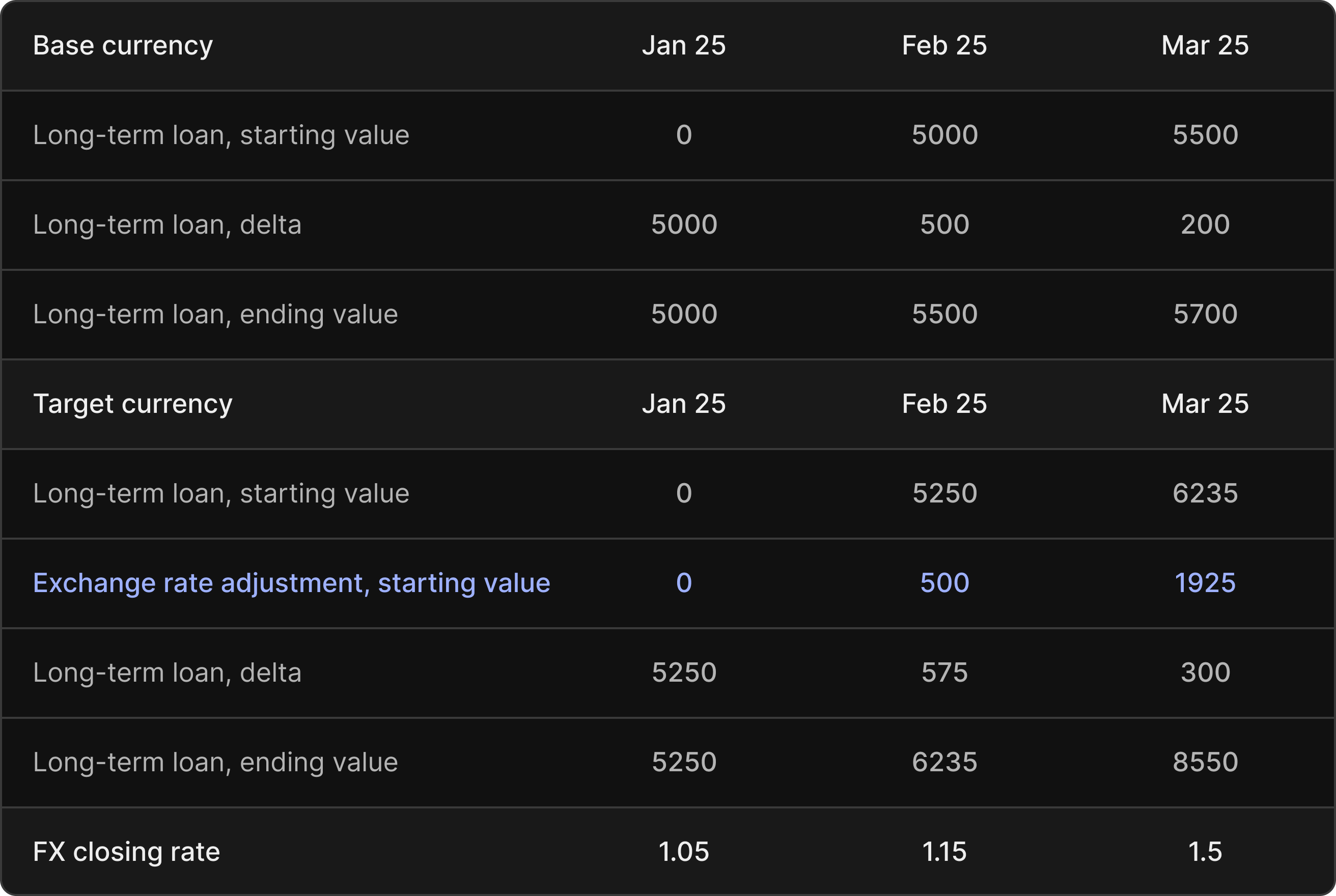

Effect 1: Current and historical rates

Opening balance sheet amounts are translated at the current month’s closing rate. This can cause balance sheet values to fluctuate due to exchange rate changes alone, even without new transactions. In practice, it means your balance sheet will reflect both financial movements and currency adjustments. In the example below, we demonstrate how to calculate the exchange rate effect resulting from fluctuating exchange rates.

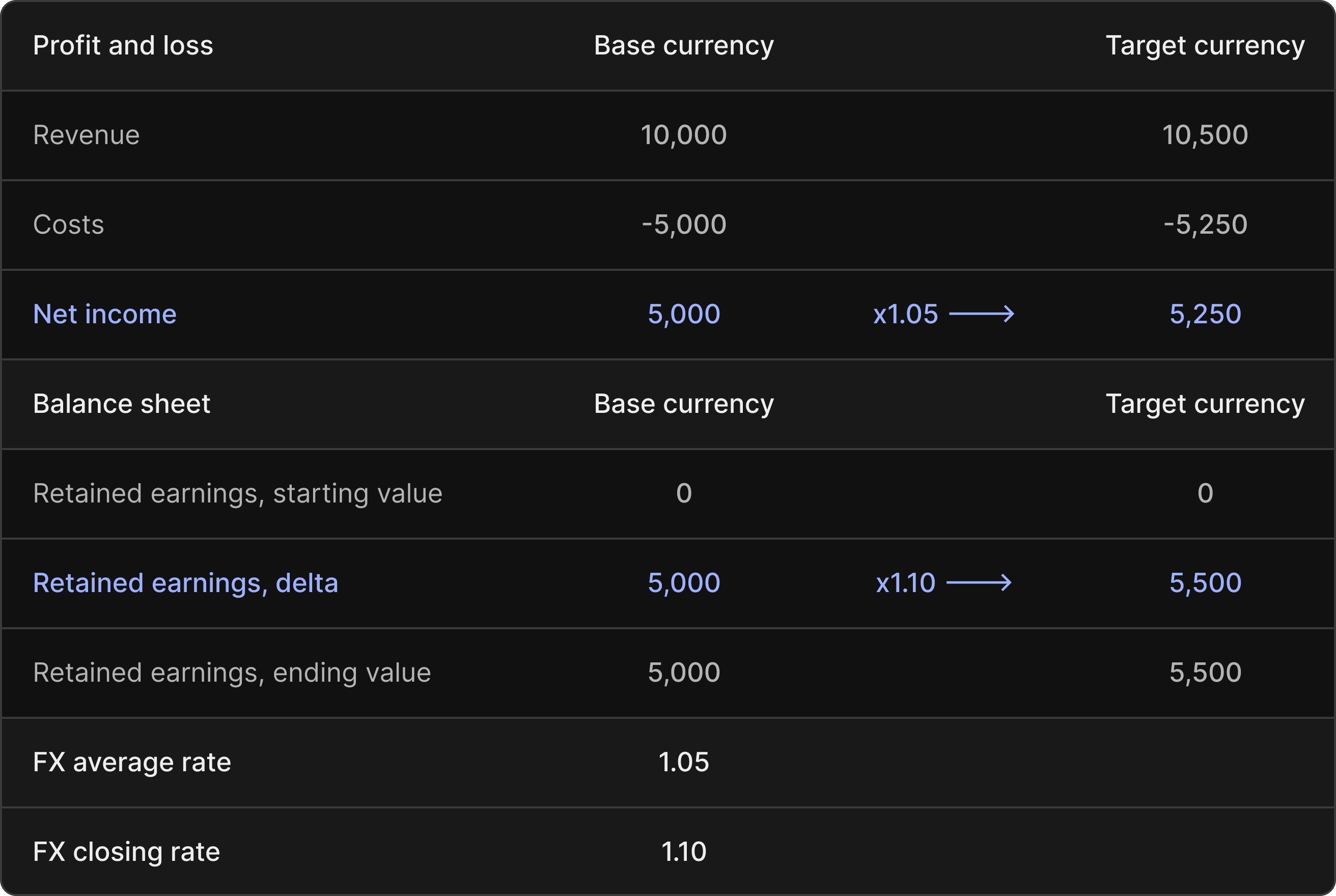

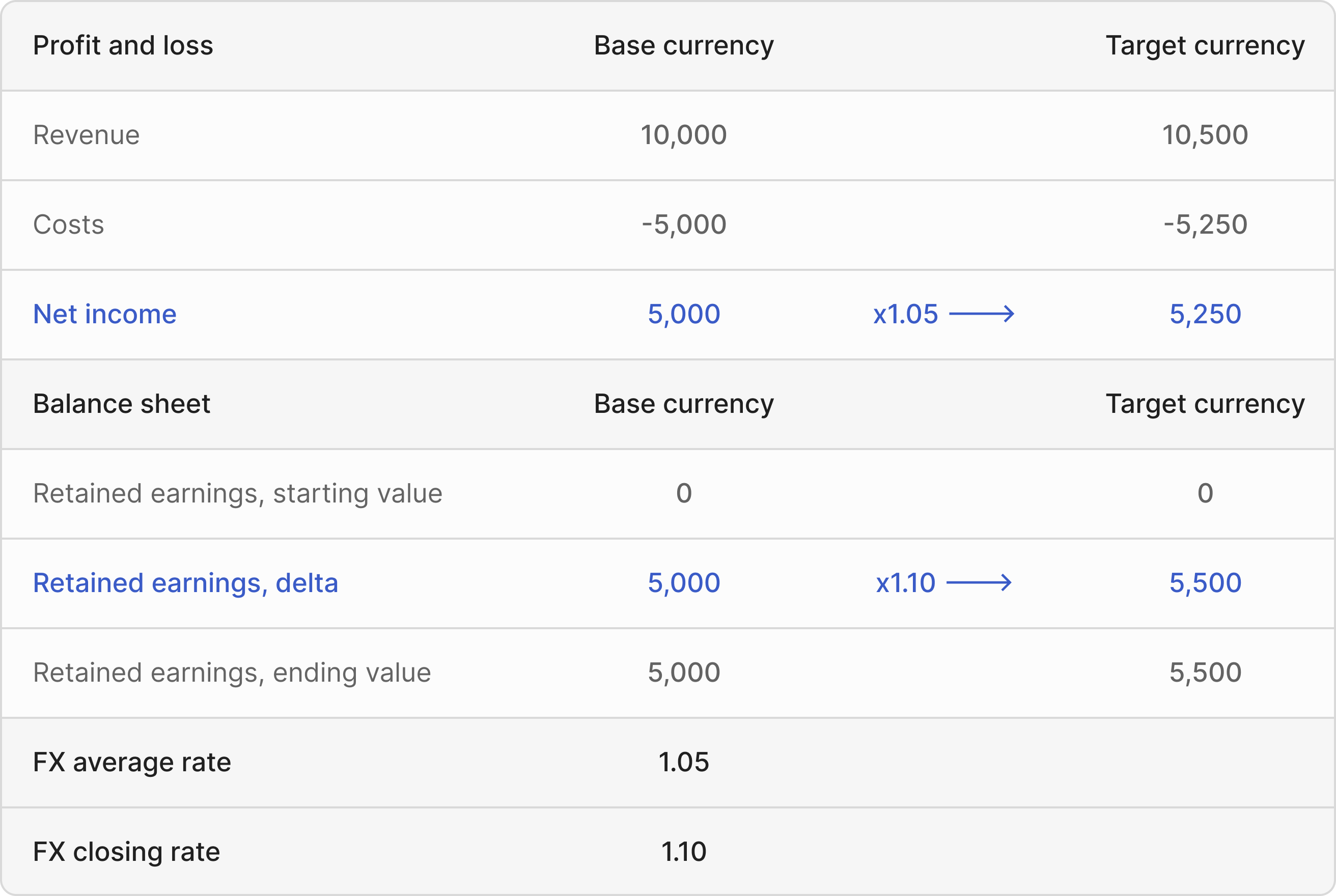

Effect 2: Average and closing rates

While P&L items are translated at average monthly rates, their corresponding balance sheet entries are translated at closing rates. As a result, the P&L and balance sheet may use slightly different exchange rates for the same underlying transactions. In the example below, we demonstrate how the difference between average and closing rates effects the equity account for retained earnings.

The 5,500 difference in retained earnings, expressed in your target currency, breaks down into 5,250 (retained earnings at average rates) and 250 (the adjustment from average to closing rate). This adjustment follows the method shown above.